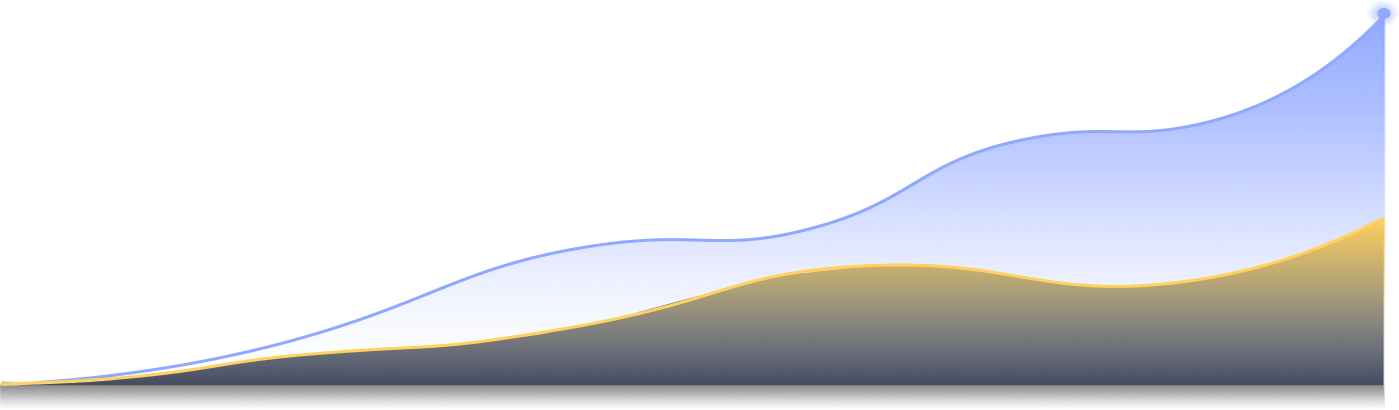

The mortgage market is humming, but getting approved for a home loan is as difficult as it has been in years.

According to the Federal Reserve Bank of New York’s June Survey of Consumer Expectations, the overall rejection rate for credit applicants increased to nearly 22%, the highest level since June 2018.

26.4% of loan applications are denied.

39% of minority applications are rejected.

The bank or mortage broker is not your friend.

We don't earn a commission from your loan.

Banking legislation has made it more difficult to obtain an approval or close in a timely fashion.

Our tailored precheck will make a daunting process seem much easier and might save you a lot of money.

Complete our intuitive questionnaire to personalize your precheck

Secure and simple one-time payment

You'll receive your precheck package that will ensure you're on the right track to get the best home loan.

Even with historically low interest rates, buying a house or refinancing a mortgage is getting tougher, and some consumer advocates worry that the pandemic fallout could hurt the homeowners with the most to lose.

We were looking to buy a home and we were in the market for a loan. We were fairly uneducated and unsure what to expect from our lender. Doing a precheck opened up our eyes! We were able to save money and stress with just a few minutes of getting the precheck.

We were referred to Mortgage Precheck by a family member to help organize our documents and guide us in the new mortgage loan that we were about to seek. Within a few hours, everything was sent to us and we were on our way to get the loan the right way! So easy, what a wonderful service!